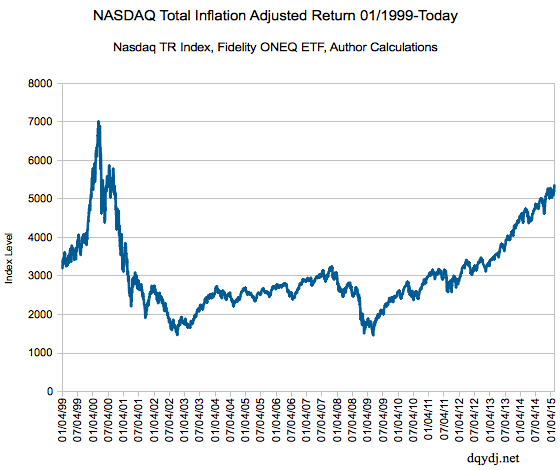

If Yahoo! Finance can be believed (yes), then the NASDAQ is approaching its all-time closing high of 5048.62, which it reached on March 10th, 2000. However, that doesn't really tell the whole story - the last fifteen years have been filled with dividend payments making today look 'better'... but have also been filled with inflation, making today look 'worse'!

So, how about it - what happens after we apply the adjustments? Is the NASDAQ, dividends and inflation included, nearing its high water mark? This post was written about the closing price of 4,893.84 reached on 2/13/2015 - but, as you'll see, it will remain applicable for quite a while.

Inflation and Dividend Adjusted NASDAQ Prices

We estimate that no, the NASDAQ is nowhere near an all time high. Our math has it down about 23.48% from its high water mark at the peak of the Tech Bubble - stated another way, it would need to gain about 30.69% (real) to reach parity with March of 2000.

So, while the recent run-up has certainly been impressive and we don't doubt that the NASDAQ index will blow through its March 2000 highs eventually - it isn't happening yet, sorry.

Methodology

NASDAQ has a total return index that has data back to 2003, but we could only grab data back to 2009 from Yahoo! Finance. Of course, the chart has data back to 3/1/1999 - so how did we do it?

Essentially, we used the Fidelity Nasdaq Composite ETF, ONEQ even though it doesn't go back to 1999. Emulating the methodology of the total return index itself (the link in the above paragraph), we used the plain NASDAQ index (price level) before then - so you have a minor error (minor because of low dividends) in the 4 years from 1999-2003. Even using the ETF QQQ to fill in the dividend gaps wouldn't work - it didn't pay dividends in that time.

So, we stuck with it. Basically, it could be slightly steeper at the 15 year ago level - so if you were buying all the stocks directly, please send us any data you may have on the dividends!

Conclusion

So, even though you might hear a bit of fanfare around the whole index level thing, remember this article - we still have a bit to go. Also, spread the word so more people can celebrate when the NASDAQ bridges the remaining 30.69% gap!