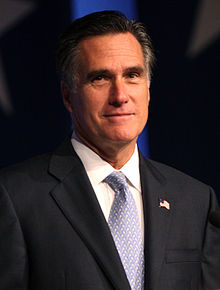

Have you ever seen an election season so dedicated to the intricacies of taxes? Mitt Romney must be glad he paid accountants to run the numbers, since just 4 years ago I seem to recall a number of issues with TurboTax.

So yes, I've never heard this much ranting and raving about taxes, even though the last time a very rich person from Massachusetts ran for President there were many similarities. So, let's talk a little bit about two different things - 'Marginal' rates and 'Effective' rates.

Marginal Tax Rates

It's very important that when we talk about "Marginal Tax Rates" we are very careful about our terminology. A marginal dollar may be taxed at many different rates depending on how it is earned and how it is spent - for example, picture a dollar earned being taxed at the state, local, and federal level, then again at the state level and federal level when it is used to buy gas. When we say (in this particular article) "Marginal Tax Rates", we mean "at what rate is a dollar of regular income or tips taxed before it is put to any other usage". Ignoring state taxes, in 2011 it broke down like this:

| Marginal Rate | Single | Married Filing Jointly | Married Filing Separately | Head of Household |

| 10% | Up to $8,500 | Up to $17,000 | Up to $8,500 | Up to $12,150 |

| 15% | $8,501 - $34,500 | $17,001 - $69,000 | $8,501- $34,500 | $12,151 - $46,250 |

| 25% | $34,501 - $83,600 | $69,001 - $139,350 | $34,501 - $69,675 | $46,251 - $119,400 |

| 28% | $83,601 - $174,400 | $139,351 - $212,300 | $69,676 - $106,150 | $119,401 - $193,350 |

| 33% | $174,401 - $379,150 | $212,301 - $379,150 | $106,151 - $189,575 | $193,351 - $379,150 |

| 35% | $379,151+ | $379,151+ | $189,576+ | $379,151+ |

So, let's say you made $150,000 so far this year, you are married and will be filing jointly. If you earn $1 more, you will pay 28 cents to the Federal Government in taxes. So your Federal Income Tax Marginal Rate is 28%. This is actually the number people usually refer to when talking about their marginal rate - they aren't including payroll taxes, or credit phase outs, or capital gains - just their income tax bracket.

Effective Tax Rates

Effective tax rates are a whole other beast. So, maybe you are in the 28% Federal tax bracket... but that doesn't mean you paid 28% of your money in taxes. You paid less - all money earned up to the threshold of a tax bracket change is taxed at the lower rates. You also received an exemption for you and your wife - and a standard deduction of $11,600. What does that mean? The first $11,600 you earned didn't have any income tax applied.

However, this analysis ignores the other major aspect of federal taxes - payroll taxes. In 2011 you paid 4.2% of your first $106,800 earned in Social Security taxes, and 1.45% of all your income in Medicare taxes. So even your first $11,600 had a bit of tax on it. So, if you earned $150,000, how much did you pay in federal taxes if you lived in a zero-tax state and took no other deductions? $31,661 - 21.1%.

Now, the huge complaint in the media is that Mitt Romney paid an effective 13.9% tax rate in 2010, and a 14.1% in 2011. Let's assume he comes into 2012 with roughly a 15% federal effective tax rate. What amount of earned income would result in a salaried employee (married, with no kids or deductions) paying that amount? Right around $65,500. Let's say you're more realistically in a house in a state with tax, and have 3 kids - so $17,500 in deductions plus the children - now you're around $126,000. So that number - $18,863 in taxes paid at the federal level - compared with your income is your effective tax rate.

The Effective Rate Media Dodge

And that's really all that there is to it - you'll find that your marginal rates are likely even lower than those I used for examples due to the effects of deductible debt, local and state taxes paid, charitable donations and tax advantaged dividends and capital gains. So, when you see the media claiming that Mitt Romney is paying less taxes than, say, people making $30,000 know you're looking at someone who doesn't know math (and if you still don't believe me, note that both Mitt Romney and Barack Obama pay more in taxes than most people make in a year). Sure, Mitt and Ann Romney (and the Kerrys/Heinzes before them) are very efficient with their taxes. That doesn't mean you should let people make ridiculous points without first considering what is being said.

Do you understand the difference between marginal rates and effective rates? Can you see now how a million dollar+ earner can pay 'so little' in taxes? Do you use TurboTax or an Accountant for taxes, or do you do them on your own?