On this page is a Wilshire 5000 Return calculator. It gives the dividend reinvested return of the Wilshire between any two dates since December 1970. It can also adjust returns for daily inflation. It uses data from Wilshire Associates, collated by the St. Louis Fed here and here.

The Wilshire 5000 Dividend Reinvested Calculator

Note: some dates 'snap' to closest data; for some of the history of the Wilshire 5000, only monthly levels were given. Check the dates after you've run the calculation.

Using the Wilshire 5000 Dividend Reinvestment Calculator

We produced this calculator because we're bothered by the math used to computer returns in a lot of posts. For whatever reason, most returns ignore dividends.

A long term investor would have to consciously spend or withdraw dividend money to avoid reinvesting it in a security. Any fair comparison would attempt to factor dividends into security returns.

Wilshire also produces a trailing return calculator which you can find here.

- Total Wilshire 5000 Return, Dividends Reinvested - The overall non-annualized return you would have made if you invested your money 'directly' in the Wilshire 5000 over the dates given and reinvested your dividends

- Annualized Wilshire 5000 Return, Dividends Reinvested - The dividend reinvested Wilshire 5000 return annualized over the dates you gave in the input.

- Total Wilshire 5000 Return - The overall non-annualized return you would have made if you invested your money 'directly' in the Wilshire 5000 over the dates given.

- Annualized Wilshire 5000 Return, Dividends Reinvested - The Wilshire 5000 price return annualized over the dates you gave in the input.

- CPI Adjusted? - Once the calculator is finished, this box will reflect whether the above results are adjusted for inflation using CPI.

Methodology on the Wilshire 5000 Return Calculator

The Wilshire 5000 is an index produced by Wilshire Associates which better measures the total United States stock market than other indexes. As we went to press, the Wilshire 5000 contained around 3,700 market-weighted components, covering most of the publicly traded stocks in the United States.

This data is from Wilshire Associates, and our calculator downloads new data every night at midnight Eastern Time, ensuring that you'll always have data up until 'yesterday', in most cases. Both index levels are collated at the St. Louis Fed:

Daily inflation numbers we calculate ourselves from monthly levels. See our methodology on this page.

Implications of Wilshire 5000 Total Returns

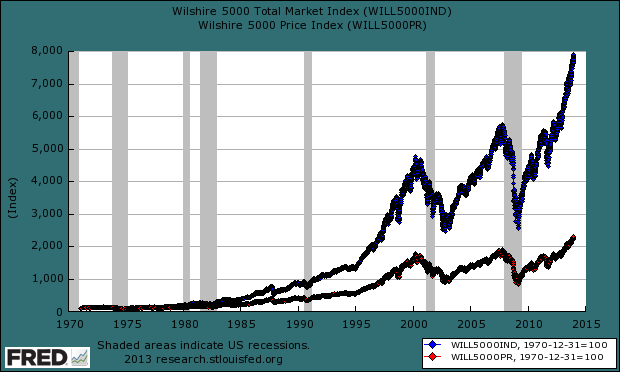

With both data points scaled to zero for December of 1970 (where the data begins), you can see the return that would have been ignored had we thrown out the dividends:

On the last day of observation (Dec 31, 1970 - Dec 28, 2013 if you want to try it), you'd be looking at 7917.0 vs. 2311.2. Dividends matter.

Also, try our ETF return calculator. Since ETFs are actually invest-able, you'd see the performance of a real investor with dividends reinvested.